A “360-day” calculation is one way of calculating receivable turnover time. Accounts receivable turnover in days calculation exampleĪ business can decrease its receivable turnover time by using a “360-day” calculation instead. Thus, 9.2 is this business’s accounts receivable turnover ratio. Suppose this hypothetical company’s net credit sales are $5,000,000.ĭivide this number by the net accounts receivable value to determine the accounts receivable turnover ratio. Next, take the net credit sales for the accounting period and divide it by the net accounts receivable balance to determine the ratio. The beginning accounts receivable balance within a single accounting period is $500,000, and the ending balance is $585,000. Suppose a company’s accounts receivable (AR) collection period is monthly. The accounts receivable turnover ratio is a financial ratio that measures the number of times a company’s accounts receivable (AR) are collected in one accounting period.Ĭheck out a real-world example of how you can calculate accounts receivable turnover below: Accounts receivable turnover calculation example A high ratio also means that the receivables are more likely to be paid in full.

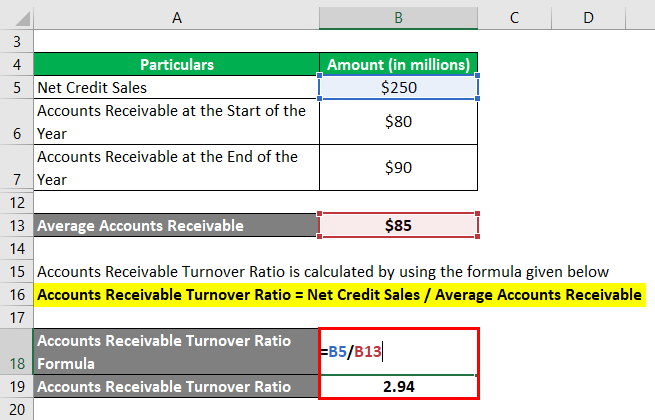

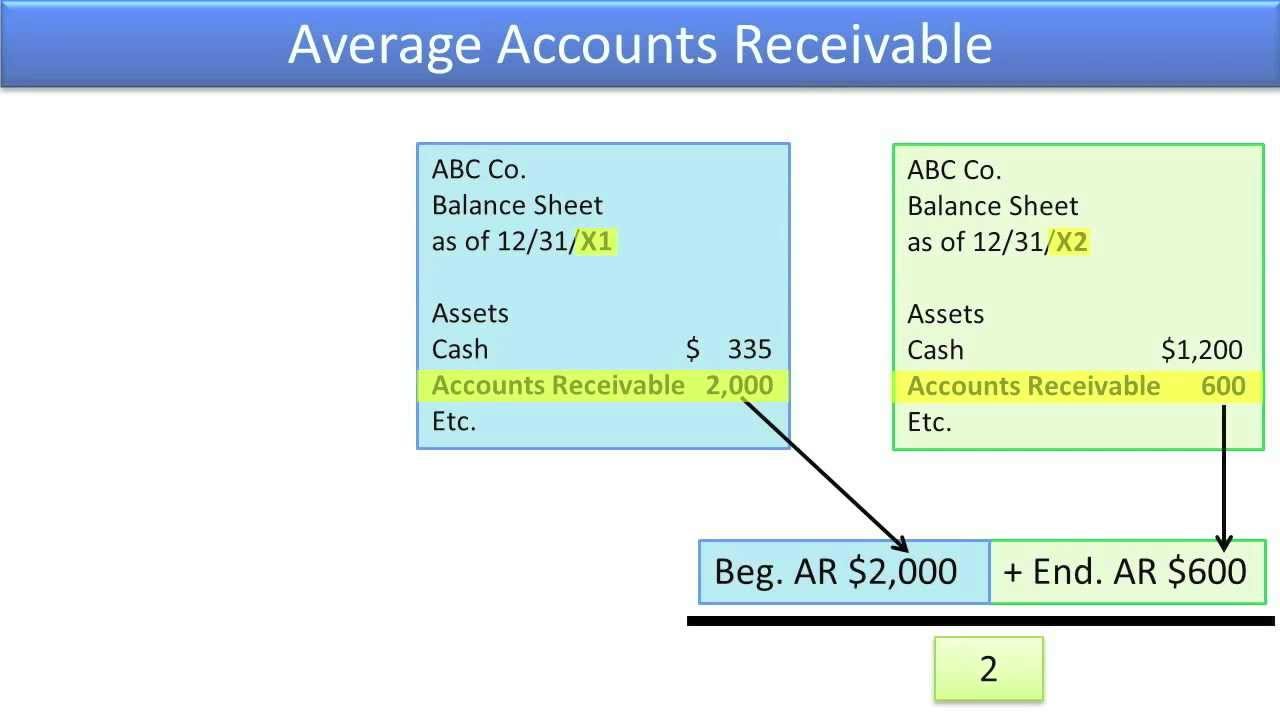

The higher the account receivables turnover ratio, the faster a company converts credit to cash. Net credit sales = Credit sales – Sales returns – Sales allowances. Net credit sales are cash to be collected later. Note: Average Accounts receivable = the starting and ending accounts receivable sums over a given time (such as quarterly or monthly), divided by 2. The accounts receivable turnover formula is:Īccounts receivable turnover (A/R) can be calculated by dividing the Net Credit Sales (CR) by the Average Account Receivables (AR). This decreases the company’s risk for a bad debt loss. In many cases, the best way to avoid bad debt is by turning receivables over faster. The accounts receivable turnover formula is used to calculate the number of times an account will be paid. This number has an inverse relationship with the days in accounts receivable. The higher the ratio, the more quickly a company can turn over its total receivables. This number measures how many times on average the company can “turn over” (collect) its total receivables each year. Accounts receivable turnover is an essential metric for measuring how fast a company can get the money it is owed by its customers.Īccounts receivable turnover is usually expressed as a ratio of annual credit sales to average accounts receivable balance.

Accounts receivable turnover is measured in monthly, quarterly, and annual periods. The accounts receivable turnover ratio measures the number of times a company converts its outstanding receivables to cash in a given period.

#Receivables turnover how to#

0 kommentar(er)

0 kommentar(er)